Your primary duty as a self-employed graphic designer is effectively and professionally managing your creative work. Nonetheless, you must handle your taxes sensibly and maintain sound financial management as an independent contractor. Managing your taxes as a freelancer might be a little more complex than for ordinary workers. Paying taxes is sometimes an intricate and time-consuming procedure. However, you may lower your tax obligations and increase your savings with the correct preparation and resources.

Completing their taxes is one of the most challenging tasks for independent contractors. Conventional workers get a W-2 detailing their earnings and the taxes deducted from their checks. As a freelancer, 1099 documents are used by your clients to make payments to you. Payments to independent contractors, freelancers, and other non-employees are reported using these forms.

Although figuring out 1099 taxes might be challenging, there is a simple method. You must check your 1099 papers and record the entire money you have received from freelancing work. Subsequently, compute your self-employment tax, encompassing Social Security and Medicare levies. Also, using a 1099 tax calculator is helpful.

Individuals who work for themselves are responsible for paying the employer and employee portions of Social Security and Medicare taxes. That implies that the amount of self-employment taxes you must pay is 15.3% of your net income, or income after costs are subtracted.

You must utilize the IRS Schedule SE form to compute self-employment tax. You must enter your net income information and the amount of self-employment tax you owe on this form.

Estimated tax payments are another item to consider. Unlike typical workers, who have taxes deducted immediately from their paychecks, freelancers have to pay their taxes every quarter. Because their employer does not withhold taxes from their income, freelancers must make what are known as estimated tax payments throughout the year.

This implies you have four annual anticipated tax payments to send to the Internal Revenue Service. These are usually due April, June, September, and January 15th. Your expected yearly income determines how much you pay.

Use the IRS website’s anticipated Tax Payments Calculator to determine your anticipated taxes. The calculator accounts for several variables that affect your tax burden, such as your taxable income, adjusted gross income, tax credits, and deductions. Naturally, you’ll still need to confirm the results with your accountant and your state’s tax rules, but the calculator might be a helpful place to start if you want an idea.

Using a self-employed tax calculator is an additional choice. A self-employed tax calculator includes all of the necessary tax codes and schedules, making it easy and quick to compute your taxes.

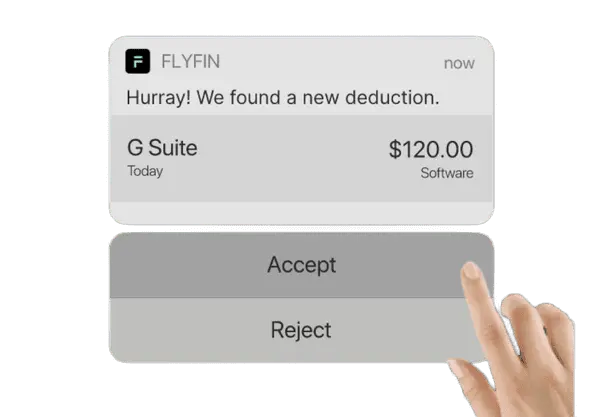

Tax calculators may assist you in estimating your taxes, finding areas where you can save money, and even offering strategies for maximizing your allowable deductions. If you work from home, for instance, you can qualify for home office deductions, which lower your taxable income by deducting your mortgage or rent.

Using an online self-employed tax calculator, you’ll enter your income and associated costs. After that, the calculator will estimate your combined federal and state tax liability. Additionally, you may modify these amounts to consider any other tax credits and deductions for which you could qualify.

Making the most of your deductions may be part of your tax plan. By utilizing tax deductions, freelancers can lower their tax obligations in many ways. If you operate as a freelancer, you may frequently write off costs associated with your job, such as office space, software, printing equipment, and computers, that would not be deductible if you were an employee.

Maintaining precise documentation of all these expenses is essential, as certain charges might not be eligible for tax deductions. The most important thing is ensuring that all of the costs you include are reasonable and related to the activities you do to create cash.

Maintaining accurate documentation is crucial to optimizing your tax deductions. You may track and organize your spending using a spreadsheet or a program like Quickbooks. This makes it simple to find places where you may save money and guarantees that you have the supporting records and paperwork required to file your tax deductions.

In conclusion, handling your taxes might be challenging, even if being a freelancer is lucrative. Although filing taxes on time can be stressful, you can minimize your tax savings and make the process more comfortable by adhering to best practices and using the appropriate tools.

Ensure you possess the necessary resources and expertise to handle your taxes effectively. Use tax calculators and other tools to ensure you adhere to tax regulations and file your taxes on time and correctly. By heeding these suggestions, you can save money on your taxes and focus on your passion project.

Also, Read The Following: Cloud managed services