When you have a business idea, gaining funding can make the difference in achieving your goal. It’s always a challenge for young entrepreneurs to raise capital for their start-ups, especially when persuading investors to get started. If you’re thinking of launching your business, there are different ways that you can build up capital. This guide helps you gain capital to make your business idea a reality.

Friends and Family

The easiest way to start your business is to borrow money from friends and family. Those closest to you will believe in your dreams better than investors or banks, and if many people pitch in, it can build up to form the needed capital.

However, if you ask your family and friends for loans, you must get legal advice to avoid conflicts. Also, be careful when asking friends for money because it can strain your relationships later.

Fund It From Your Savings

The easiest way to find capital for your business is to fund it yourself. If you have a day job, you can put aside some savings and use these to raise capital. Although supporting your business is risky, it will be worthwhile if you believe in the idea. If you don’t have confidence in it, there’s no point asking friends or investors to commit to it, either.

Funding with low or no-interest credit cards and mortgages on your home is also possible. These can give you affordable credit to get your business up and running. But always keep the risk in mind; if it doesn’t succeed, you’ll have a significant amount of debt to handle.

If you have no savings, another option is to keep your day job. This might not be ideal, but you should not hurry to quit your job and start your business. Use the nine-to-five job to pay your bills and fund your business while trying to get it off the ground.

Trading Forex

Another way to earn capital for your business is trading forex. Investing in foreign exchange is profitable but not a get-rich-quick scheme. Based on your strategy, you can trade forex short-term or long-term.

Trading forex requires some training and background knowledge, so conduct research in the kinds of trading you want to do, what your profit goals are, and which currencies make the most sense to invest in before you begin. Gain practical experience with small trades and learn from your wins and losses. As a side hustle, this is a reliable way to earn money you can reserve for your small business.

Small Business Loans

Many banks offer small business loans, although they are not always optimistic about giving these out, and it’s difficult to qualify. There are other lending companies to consider which can help you launch your business.

On the downside, you must choose the alternative lender carefully since some can be predatory. Ensure you conduct due diligence before signing the contract to get a loan from these services.

Small Business Grants

Different organisations provide grants to small businesses run by minorities, women, or veterans. One of these is the Small Business Administration, so you can consider talking to your local chapter or contacting the Chamber of Commerce to see if there are any grants you qualify for.

But you should carefully read the conditions of a Small Business Administration grant offered before you sign up for it. It’s also essential to ensure you won’t need to return the money to the organisation. Although not all grants come with stipulations, you should know what to expect before accepting the money.

Crowdfunding

If your business idea is carving out a new niche and you are good at navigating social media, you can consider crowdfunding. There are different websites for businesses to get funding through crowdfunding, including Indiegogo and Kickstarter. Many businesses have gained funding with these platforms.

A downside to this option is that many companies try this method, so you’ll have to work harder to stand out.

Local Contests

When looking at contests for new business owners, there are different options that you can consider. You don’t have to try getting on Shark Tank, as this is difficult to enter, but there are local competitions with a similar style.

Since these contests are local, there will be less competition, and you can appeal to your immediate community. So, you can search for contests being carried out in your area. Local contests also give you practise for pitching to investors. And even if you don’t win, the local community will learn about your business.

Incubator or Accelerator Program

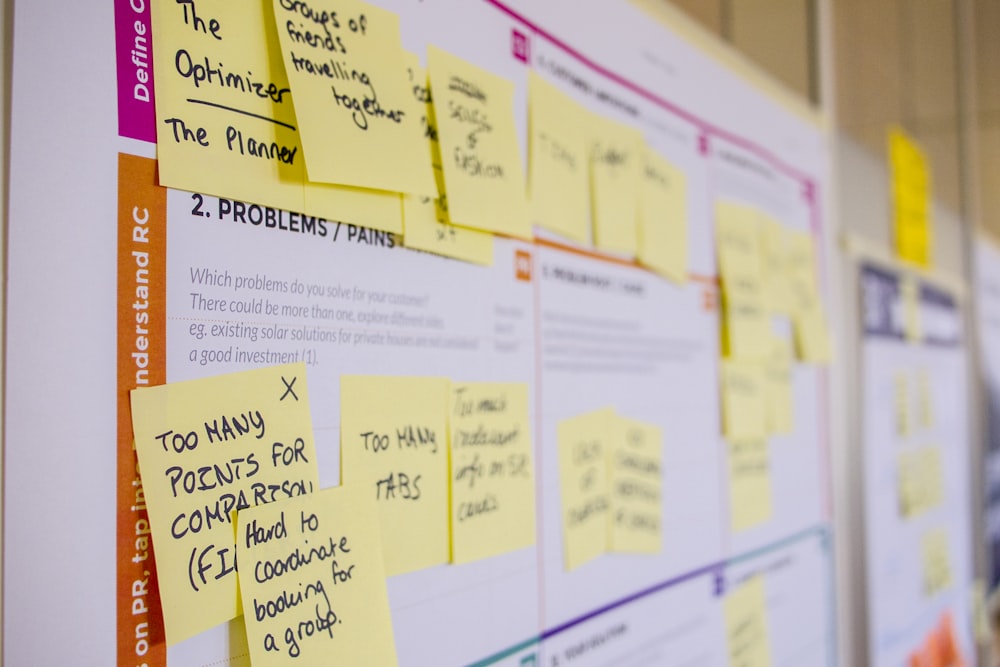

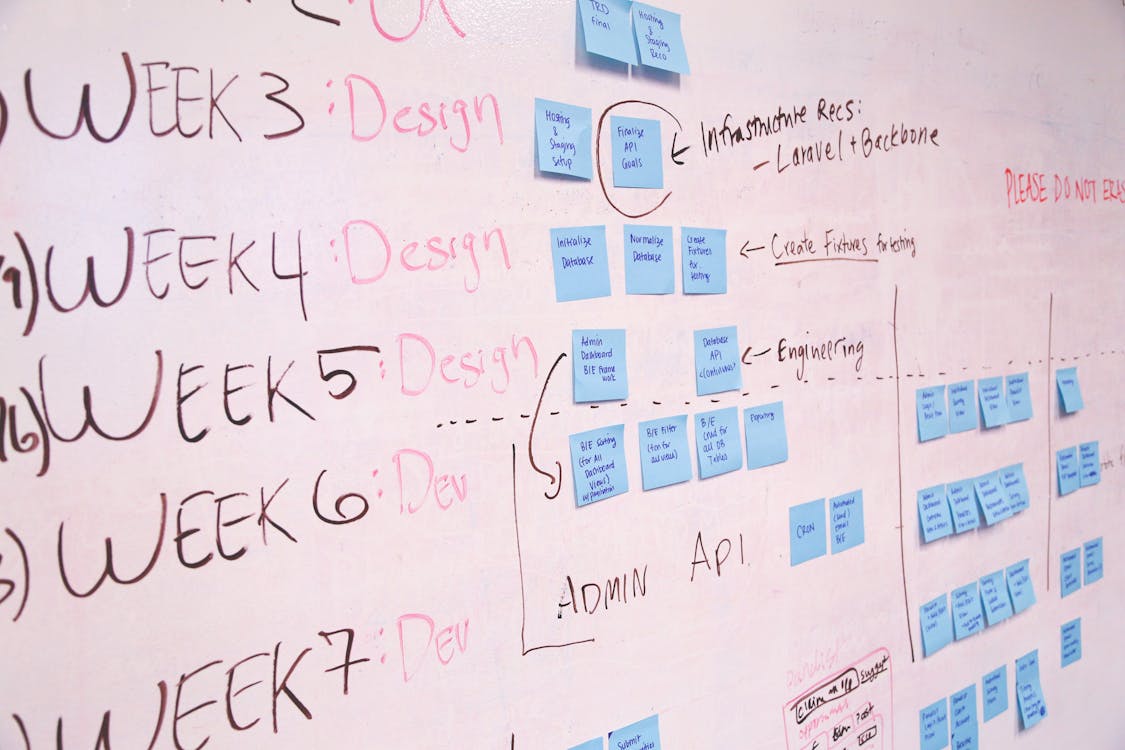

There are different business incubator and accelerator programs around the United States, especially for young college students or graduates with a good business idea. These programs combine mentorship with a communal workspace, helping small businesses find their footing.

Incubators are suitable for early-phase start-ups that don’t have a developed business model yet. On the other hand, accelerators are ideal for existing companies with a minimum viable product and help speed up their growth. Most of these programs are focused on tech-heavy businesses, so you’ll have to look closely to find the ideal one for your company.

Get Your Start-Up Up and Running With These Tips

Depending on your business idea and situation, there are different ways to secure funding and start running your start-up. It’s essential to research and choose one suitable for your case. If your friends and family are enthusiastic about your idea, you can consider borrowing from them. Or, if you think you can showcase a unique business idea to the community, join a contest. Focus on putting money together without negatively disturbing your relationship with others or affecting your financial situation.

Also, Read The Following: Value Doors.