In today’s rapidly evolving business landscape, sustainability has become a paramount concern for organizations worldwide. As businesses strive to reduce their environmental footprint and embrace renewable energy solutions, the role of finance emerges as a crucial enabler in this transition. Renewable energy finance offers businesses the opportunity to invest in clean energy technologies, driving both environmental stewardship and financial success.

1. Understanding Renewable Energy Finance for Business

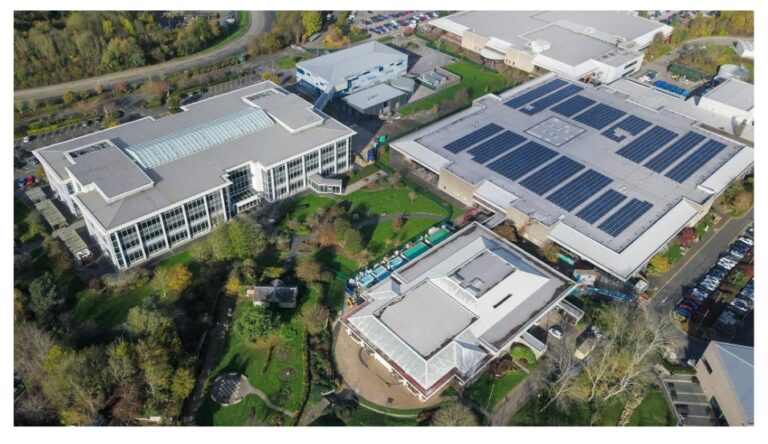

Renewable Energy Finance for Business involves the provision of funding and financial mechanisms to support companies in adopting renewable energy solutions. This can include financing options for solar panels, wind turbines, energy-efficient technologies, and other renewable energy projects. By leveraging renewable energy finance, businesses can reduce their reliance on fossil fuels, lower their carbon emissions, and contribute to a more sustainable future.

2. The Benefits of Renewable Energy Finance

Investing in renewable energy finance offers numerous benefits for businesses. Firstly, it allows companies to lower their energy costs over the long term by generating their electricity from renewable sources. Additionally, renewable energy projects often qualify for government incentives, tax credits, and other financial incentives, further enhancing their economic viability. Moreover, embracing renewable energy can enhance a company’s reputation as a socially responsible and environmentally conscious organization, attracting customers, investors, and top talent.

3. Driving Environmental Stewardship

Renewable energy finance plays a crucial role in driving environmental stewardship within businesses. By investing in renewable energy projects, companies can significantly reduce their carbon footprint and mitigate the environmental impact of their operations. This proactive approach to sustainability not only benefits the planet but also aligns with evolving consumer preferences and regulatory requirements.

4. Enhancing Energy Independence

One significant advantage of renewable energy finance is the opportunity it provides for businesses to enhance their energy independence. By generating their electricity from renewable sources such as solar or wind, companies can reduce their reliance on traditional energy sources and insulate themselves from energy price volatility. This increased energy independence can improve operational resilience and reduce risks associated with energy supply disruptions.

5. Leveraging Innovative Solutions from CQuel Net Zero Solutions

CQuel Net Zero Solutions offers innovative financing options and consultancy services to help businesses transition to renewable energy and achieve sustainability goals. With expertise in renewable energy finance for business, CQuel provides tailored solutions to meet the unique needs of each organization. From initial assessment to project implementation, CQuel guides businesses through every step of their sustainability journey, empowering them to make meaningful and impactful changes.

6. Overcoming Financial Barriers

While the benefits of renewable energy finance are clear, some businesses may encounter financial barriers when considering renewable energy projects. However, innovative financing options such as power purchase agreements (PPAs), energy efficiency loans, and third-party financing can help businesses overcome these barriers. By spreading the upfront costs of renewable energy projects over time and aligning financing with energy savings, these solutions make sustainable investments more accessible and affordable for businesses of all sizes.

7. Demonstrating Corporate Responsibility

Embracing renewable energy finance is not just about financial gains; it’s also about demonstrating corporate responsibility and leadership. Businesses that prioritize sustainability send a powerful message to customers, employees, and stakeholders about their commitment to environmental stewardship and social responsibility. By integrating renewable energy into their operations and financing strategies, companies can position themselves as leaders in their industries and inspire others to follow suit.

8. Maximizing Return on Investment

Renewable energy finance offers businesses the opportunity to achieve a significant return on investment (ROI) over time. While there may be upfront costs associated with implementing renewable energy projects, the long-term savings and benefits far outweigh these initial investments. By reducing energy costs, minimizing operational risks, and enhancing brand value, businesses can maximize their ROI and drive sustainable growth.

9. Addressing Common Concerns and Misconceptions

As businesses explore renewable energy finance options, they may encounter common concerns and misconceptions. These could include worries about the reliability of renewable energy sources, the complexity of financing arrangements, or the perceived high upfront costs. However, with the guidance and expertise of renewable energy finance providers like CQuel Net Zero Solutions, these concerns can be addressed, and businesses can confidently embark on their sustainability journey.

10. Embracing a Sustainable Future

In conclusion, renewable energy finance plays a pivotal role in empowering businesses to embrace sustainability and drive positive change. By investing in renewable energy projects, companies can reduce their environmental impact, lower their energy costs, and demonstrate corporate responsibility. With innovative solutions and expert guidance from providers like CQuel Net Zero Solutions, businesses can navigate the complexities of renewable energy finance and position themselves for long-term success in a sustainable future.

FAQs

1. What is Renewable Energy Finance for Business, and how does it benefit companies?

Renewable Energy Finance for Business involves providing funding and financial mechanisms to support businesses in adopting renewable energy solutions. It benefits companies by reducing energy costs, enhancing environmental stewardship, and demonstrating corporate responsibility.

2. How can businesses overcome financial barriers when considering renewable energy projects?

Businesses can overcome financial barriers through innovative financing options such as power purchase agreements (PPAs), energy efficiency loans, and third-party financing. These solutions spread upfront costs over time and align financing with energy savings, making sustainable investments more accessible.

3. What role does CQuel Net Zero Solutions play in helping businesses transition to renewable energy?

CQuel Net Zero Solutions offers innovative financing options and consultancy services to help businesses transition to renewable energy and achieve sustainability goals. With expertise in renewable energy finance, CQuel provides tailored solutions to meet the unique needs of each organization, guiding them through every step of their sustainability journey.