Success is not an easily-defined term. Success is often predicated on specific and individual markers, which do not necessarily measure up against those of others. Still, many entrepreneurs style themselves after the Western world’s most infamous success stories: Steve Jobs, Elon Musk, Jordan Belfort amongst many others.

These trail-blazing entrepreneurs, and the venture capitalists that invariably funded them, have some common threads tying them together. These threads describe the essentials of managing money, and the cribs by which they were able to weaponise their skills in order to become behemoths of finance and industry. But what threads are they, and how can you tie yourself to them?

Smart Budgeting

Firstly, you need to have a strong grasp of financial literacy. This is not necessarily easily-learnt, as evidenced by the ten-plus million people heavily in debt across the country – but it is a skill that you must learn nonetheless. Budgeting is a core skill, that enables you to shore up viable and valuable savings whilst exercising restraint and living within your means. With the right approach to budgeting, you can take lessons learned across to business practices and understand exactly when spending is an appropriate action.

Strategic Investing

This is where shrewd investment comes into play. Successful businessfolk are successful because of their keen eye for a good deal – Warren Buffet being one of the more prescient examples. Investment is not a gamble, but rather the staking of money on informed decision-making. Through expert insights and factfinding, you can chart a course to medium-term profitability; engaging the right counsel for your investment income can bolster yourself for the longer term and ensure the financial security to continue your growth journey.

Debt Management

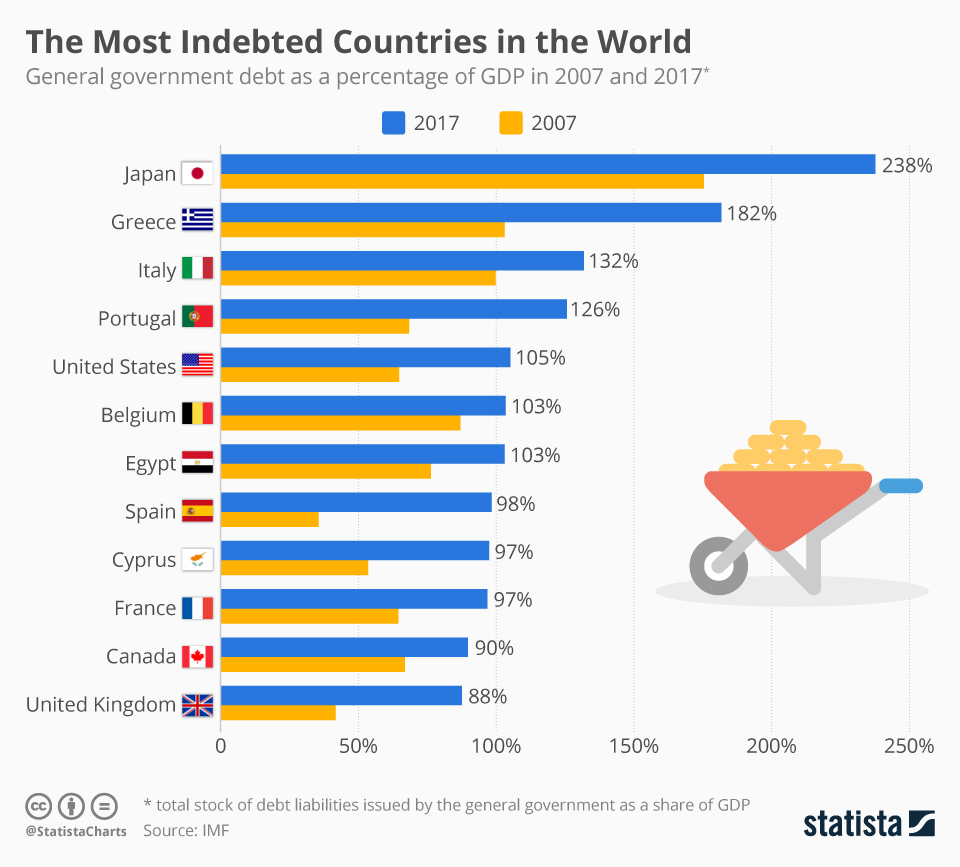

Of course, with investment and business growth comes debt. Debt is in fact an extremely powerful tool in the right hands, and often the sole mechanism by which high-profile investors claim their worth. In leveraging debt correctly, successful entrepreneurs minimise risk while maximising profitability. This, though, is often a high-stakes game when played poorly; for early adopters, debt should be kept to properties, in order that it remains secured and hence secure.

Long-Term Wealth-Building

All of this is with a view to the long-term, but there are especial routes to guaranteeing that long-term success beyond simply manning ship while investments grow. Active investment in the stock market is great for short-term gains, but utilising global funds is a powerful way to harness the markets in achieving returns greater than conventional interest.

Global funds are stable as a result of being diverse – a lesson you could stand to learn, too. Splitting investments across industries or products ensures that no one failure is your complete and utter downfall; just as today’s success stories endured failure after failure in pursuit of success, so too will you. The difference is you will be more resilient, on account of having learned from their mistakes.

Also, Read The Following: negative impacts of financial events on the property market