If you’re wondering how to make money on Airbnb or any other vacation rental platform, it’s essential to understand the tax implications of your hosting income. Vacation rental taxes can be complex and vary depending on your location and circumstances. In this comprehensive guide, we’ll explore the ins and outs of vacation rental taxes, helping hosts navigate the tax landscape and stay compliant with the law while maximizing their earnings.

- Understanding Occupancy Taxes

Occupancy taxes, often referred to as lodging taxes, are imposed by many municipalities on short-term rental accommodations. These taxes can be levied by cities, counties, or even states, and the rates and rules can differ significantly. It’s crucial for hosts to research and understand the occupancy tax requirements in their specific location.

- When to Collect and Remit Taxes

In most cases, hosts are responsible for collecting occupancy taxes from guests at the time of booking or check-in. The collected taxes must then be remitted to the relevant tax authorities. It’s vital to determine the exact timing and method for tax collection and reporting in your area, as failure to comply can lead to penalties.

- State and Local Tax Regulations

In addition to occupancy taxes, there may be state or local sales taxes that apply to your vacation rental income. The rules can vary widely, and not all states impose these taxes on short-term rentals. To ensure compliance, hosts should check with their state’s department of revenue or tax authority to understand the specific requirements.

- Tax Deductions and Write-Offs

Hosts can often take advantage of tax deductions and write-offs to reduce their overall tax liability. Common deductions may include expenses related to property maintenance, repairs, cleaning, and property management fees. However, to claim these deductions, it’s essential to keep accurate records of all expenses associated with your vacation rental.

- Record-Keeping and Documentation

Proper record-keeping is crucial when it comes to vacation rental taxes. Hosts should maintain comprehensive records of all financial transactions, including rental income, expenses, and tax payments. Keeping organized records ensures that you have the necessary documentation to accurately report your income and deductions.

- Short-Term vs. Long-Term Rental Taxation

The taxation of short-term and long-term rentals can differ significantly. Long-term rentals (typically rentals exceeding 30 days) are often subject to different tax rules. Hosts who offer both short-term and long-term rentals should be aware of the distinctions in tax treatment for each type of rental.

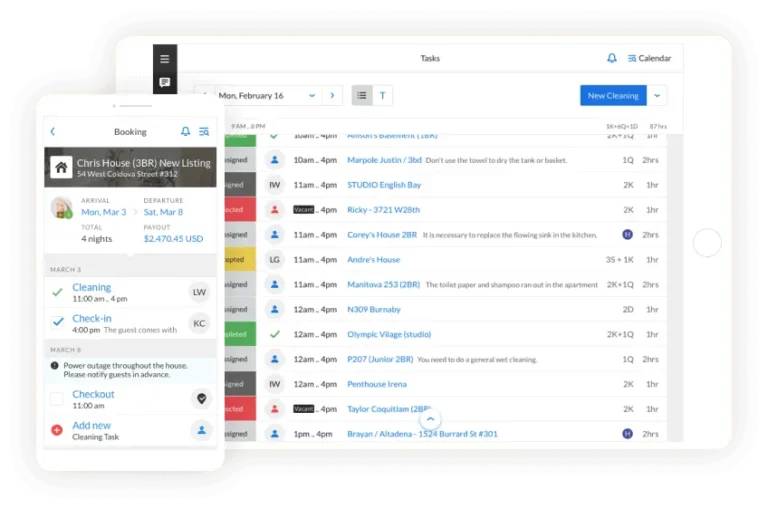

- Tax Software and Professionals

Managing vacation rental taxes can be complex, especially for hosts with multiple properties in different locations. Many hosts opt to use specialized tax software or hire tax professionals to help them navigate the intricacies of vacation rental taxation. These resources can streamline the tax process and ensure compliance.

- Online Booking Platforms and Tax Collection

Some online booking platforms, including Airbnb, have introduced features that allow hosts to automatically collect and remit occupancy taxes on behalf of hosts. Hosts should check with their specific platform to see if this service is available and how it works.

- Local Resources and Support

Local tax authorities and agencies often provide resources and support to help hosts understand and comply with vacation rental tax regulations. It’s advisable to reach out to local government offices or tax departments for guidance, as well as any available educational materials.

- Regular Updates and Adjustments

Vacation rental tax regulations can change over time, so it’s essential for hosts to stay informed about updates and adjustments in tax laws. Keeping abreast of changes ensures that you continue to meet your tax obligations and avoid potential penalties.

Conclusion

Understanding vacation rental taxes is an integral part of running a successful hosting business and learning how to make money on Airbnb. By comprehensively exploring the tax landscape, collecting and remitting taxes, claiming deductions, and keeping meticulous records, hosts can navigate the complexities of vacation rental taxation while maximizing their earnings. Staying informed, leveraging available resources, and seeking professional assistance when necessary will help hosts remain compliant with the law and maintain a thriving vacation rental business.

Also, Read The Following: handheld confetti cannon