Opening a credit card merchant account in the UK is a significant step for any business looking to expand its payment options and enhance customer convenience. Below, we delve into the essential information and practical tips to consider when setting up this service, ensuring that your business is well-prepared for the transactions ahead.

Understanding the Basics

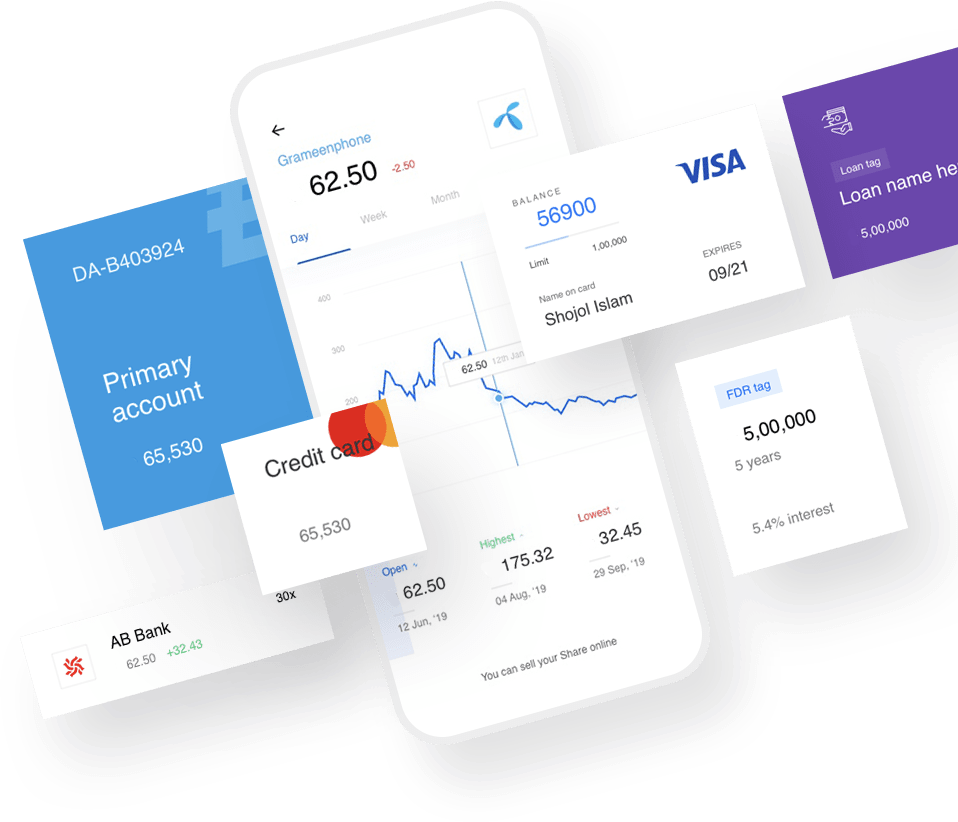

Before you begin the process of opening a credit card merchant account, it’s important to understand what it entails. Essentially, this type of account allows your business to accept credit and debit card payments from customers. The account acts as an intermediary, handling the transaction between customer, merchant, and the respective banks. It’s a crucial component for modern businesses in the digital age, as consumers increasingly prefer cashless transactions.

Choosing the Right Provider

When selecting a provider for your credit card merchant account in the UK, it’s crucial to choose a reputable company that offers competitive rates, excellent customer service, and robust security measures. We Tranxact LTD stands out as a trusted partner, offering bespoke services tailored to your business needs. With their expert guidance, you can ensure that your merchant account is set up efficiently and securely, with a clear understanding of all fees and contract terms.

Comprehending Fees and Charges

Every credit card merchant account comes with its set of fees and charges. These may include transaction fees, monthly account fees, setup fees, and possibly even penalty fees for early termination. Businesses need to be acutely aware of these charges and how they impact overall costs. Transparent pricing structures and a thorough explanation of all potential fees are part of the service.

Meeting Compliance Requirements

Regulatory compliance is a critical aspect of operating a credit card merchant account in the UK. This means adhering to standards such as the Payment Card Industry Data Security Standard (PCI DSS). Ensuring that your business meets these standards is vital for safeguarding customer information and maintaining trust. Providers like We Tranxact LTD can offer invaluable support in navigating the complex landscape of compliance.

The Importance of Security

Security is the top priority when doing credit card transactions. Fraud and data breaches can severely damage a business’s reputation and finances. High-level encryption, secure payment gateways, and fraud prevention tools are essential features that your merchant account provider should offer. We Tranxact LTD places a strong emphasis on security, helping to protect your business and your customers from potential threats.

Setting Up Your Account

The actual setup process can vary depending on the provider, but typically involves an application where you provide details about your business and its financials. A credit check and review of your business model may also be part of the process. It’s essential to work with a provider, that simplifies this process, offering guidance and support at every step.

Maximizing Your Merchant Account

Once your credit card merchant account is active, it’s important to maximize its potential. This means integrating it smoothly with your existing systems, ensuring uptime, and providing customers with a seamless payment experience. Analyzing transaction data can also offer insights into customer behavior and help streamline your business processes.

Customer Support and Service

Finally, reliable customer support is the backbone of any credit card merchant account service. Should you encounter any issues or have questions, a dedicated support team can make a world of difference. We Tranxact LTD is known for their exceptional customer service, providing peace of mind that help is available when you need it most.

Conclusion

Opening a credit card merchant account in the UK involves careful consideration of provider selection, fee structures, security measures, and compliance with regulations. By partnering with We Tranxact LTD, businesses can navigate these waters with confidence, backed by expert support and comprehensive services that ensure your merchant account operates smoothly, allowing you to focus on growing your business.

Also, Read The Following: how to make money on Airbnb